Wow it’s now confirmed by the Met Office that June this year was the hottest since 1884. The average mean temperature was 15.8 degrees centigrade, compared to the previous record of 14.9 c. In the past extremes of temperature like these have not been a real benefit to the golf market. Some, particularly older players, find it too hot to play, while those with young families are often attracted away from their courses in favour of time on the beach and in the sea. So, how did it pan out this June for the

golf industry?

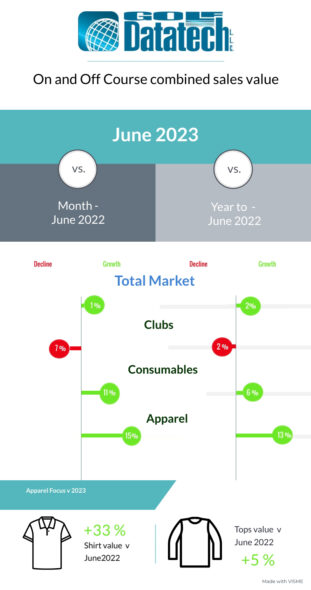

Three out of the four product groups performed well in value terms ranging from +4.6% for light durables to +15.0% for apparel. Unfortunately, the one group that currently accounts for 43.5% of the overall mix, clubs was down by -7.2% compared to the same period last year. So, the overall performance for June still remained positive at +0.7% but the trend has dipped down a little more compared to the previous three months: March at +7.7%, April +4.0% and May +3.9%. A weak result but possibly not unexpected considering the exceptionally hot weather.

Drilling down to individual hardware products we find a wide spread of results. These range from -13.9% for trolleys to + 20.3% for gloves. Certainly, the products with the higher price points faired worst such as trolleys, many of which will be electric, and irons. The the apparel groups performed well with six out of the seven products showing growth. These ranged from +1.7 for men’s trousers and shorts to +54.2% for women tops. The one exception was outerwear at -23.5% compared to the same period last year. Again,

not surprising considering the weather.

The split between on and off course sales has change over recent years. In 2019 on course outlets held a market share of 60.4%. This has dwindled, currently standing at 56.4%. One factor that is noticeable is off course pricing. In the year to date seven hardware products out of the ten reported on by Golf Datatech have seen price reductions ranging from -1.6% for balls to -11.2 for shoes compared to the same period last year. In contrast on course pricing over the same period has seen only two reductions of -0.2% for distance devices and -2.5% for shoes.

The general opinion is that consumers are becoming more canny. Yes, they are looking for competitive prices and are shopping around both online and in bricks and mortar for the best value buy. This does not mean cheap products but the best combination of price, which is still top of buyers’ minds, quality and customer service. Some may even be attracted to used quality merchandise from a well-known brand that has been refurbished, giving them both an upgrade to their ageing kit and playing their part in saving the planet which is becoming increasingly important to many.

So, what of the future. The picture is still blurred. The fall in inflation seen in June is very encouraging and could play a valuable part during the second half of the year. But the likelihood of further increases in interest rates could negate this effect. So, the future for retailers in general continues to look tough. Remember, that those that continue to market themselves have been shown in the past, to come out stronger and recover quicker than those that don’t. GR

Golf Datatech is a world leader in golf industry research. It provides the trade with specialised market research covering retail sales, inventory, pricing, distribution, along with strategic sales and marketing consultancy. In the UK, Golf Datatech research is based on an average of 2,000,000 records per month, recorded by EPOS systems at the point of sale.

For greater detail contact John Hassett on 07976 797081